Reliable Accounting & Tax Services

SKG Tax is a firm that's committed to providing our Stamford area clients with affordable tax return preparation and next-level tax services. Leveraging the best technology available, our knowledgeable professionals can spend more time providing you with personalized advice and tax solutions. Our core principle is that good communication is key and we custom-tailor our services to save you time, money, and stress.

You deserve a tax professional who will offer proactive guidance and assistance to implement the best tax strategies for your personal or business needs. At SKG Tax, we are a different kind of tax advisor and strive to offer the best value in tax services for our friends and neighbors in Stamford or the North Jersey communities. Our goal is to provide high-quality tax services and advice at an affordable price!

Learn More About UsWhy You Should Hire A Business Accountant

Doctors, restaurant owners, daycare operators, attorneys, and other busy professionals have to focus on their business to ensure they provide the best care, service, or expertise for the people who are counting on them. Having a reliable business accountant on your side can play a vital role in navigating complex tax situations, ensuring compliance, and making informed decisions for your business.

At SKG Tax our business accounting, bookkeeping, and tax services enable our business partners to monitor their cash flow, manage their budgets, and support optimal business growth. Come work with the business accountants who know that tax services and business planning don't just end when your return is filed - call us today to request a free initial consultation for services in Stamford and the neighboring areas.

Contact Us Today!

Need Help Filing Taxes?

Individual Tax Preparation

- Individual Tax Return Preparation

- IRS Audit Representation

- Multi State Filers

- Residency/Domicile Audits

- Tax Advice for Remote Workers

- Owe back taxes

- Unfiled Tax Returns

- Installment Plans

- Offer In Compromise

- Voluntary Disclosure

- Tax Implications of Divorce

- Extensions

- Estimates

Business Tax Preparation

- Partnerships

- S-Corps

- C-Corps

- Pass Through Entity Tax

- NJ BAIT

- Tax Compliance

- QuickBooks Online Accountant

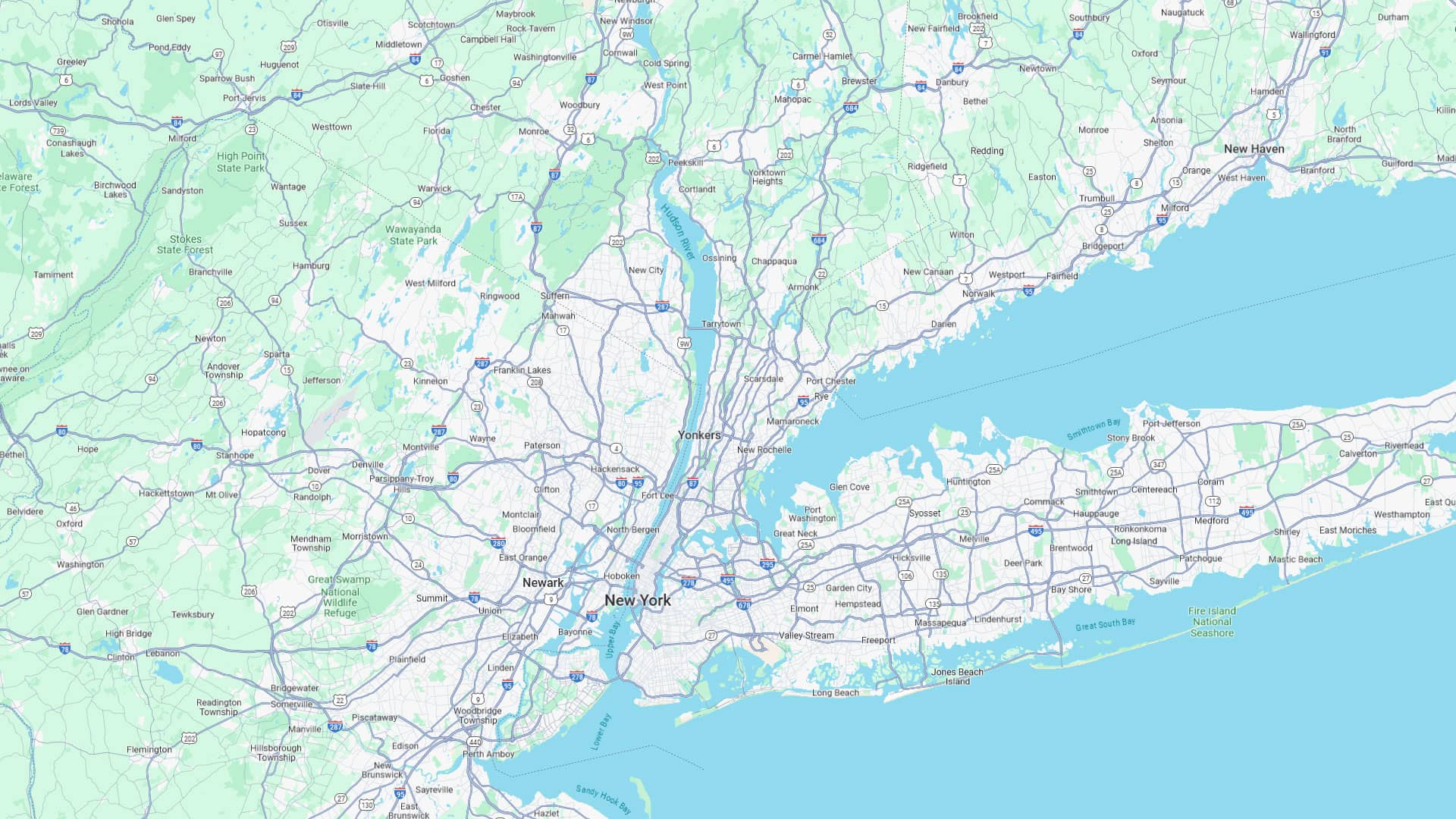

Areas We Serve

We Serve The Tri-State Area

FAQS

The business accounting pros at SKG Tax are proud to serve a growing number of clients in Stamford and North Jersey, - from doctors' offices to delicatessens to daycares, we can handle your tax services effectively, efficiently, and affordably. We're experienced in business tax preparation for a variety of entities including partnerships, S-corps, C-corps, pass-through entities, and more. Outsourcing your accounting and tax services to the experts at SKG Tax can save you time, money, and stress. Call us today to request a consultation for services in the Stamford area.

Receiving an audit notice from the IRS can be alarming, but the pros at SKG Tax can help. An IRS audit notice doesn't automatically mean that something is wrong with your return, but it does indicate that your return was selected from a batch of returns for closer inspection. Having an experienced tax services specialist in your corner can give you guidance and peace of mind - they can even advocate on your behalf with the IRS to protect your position. Even if you have a special tax situation, the accounting experts at SKG Tax have you covered. If you've received an IRS audit notice for your personal or business taxes, contact us to schedule a consultation.

A business audit examines your company's financial records to ensure their accuracy. A systematic review of your financial statements, accounting books, customs declarations, or other documents should be expected, along with questions about your business operations, bookkeeping practices, policies, and internal controls.

SKG Tax offers a full spectrum of tax services for individuals and can offer you personalized advice no matter what your filing status. When you're married, choosing a single or joint return can impact the deductions, credits, and tax breaks that are offered, which can make a big difference in your refund or the amount you own. The pros at SKG Tax understand tax laws inside and out and can help you choose the right filing status to fit your personal needs. If you're looking for high-quality tax preparation and advice at an affordable price, come work with the pros at SKG Tax.

Latest Articles

-

5 Ways Professional Accounting Services Save You Time and Money

Managing your finances as an individual or business owner can be time-consuming, stressful, and prone to error if you're not a trained expert. That’s why investing in professional accounting services isn’t just a luxury. It’s a smart move that can lead to long-term savings and efficiency. […]

-

Maximizing Your Tax Benefits: How Stamford Couples Can Gain from Filing Jointly

Joint tax preparation offers significant financial advantages, making it a smart choice for many Stamford residents. This tax filing status allows couples to benefit from higher income thresholds, increased tax credits, and a streamlined filing process. With the help of a professional accountant, Stamford couples can […]

Start Planning Today